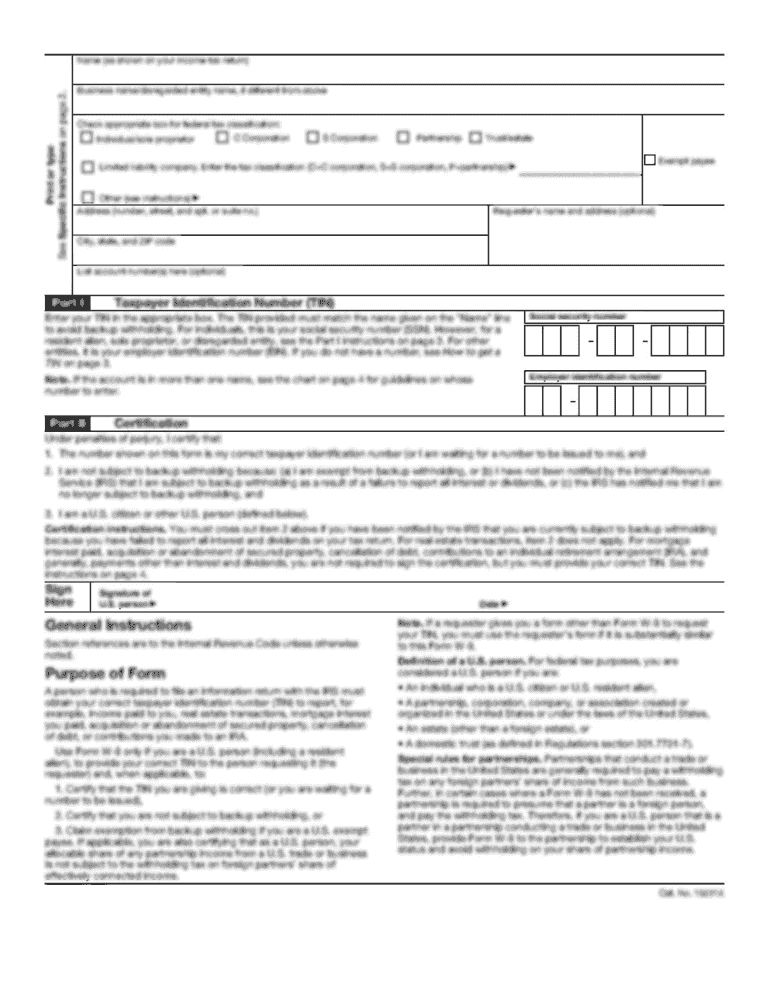

Get the free blank 1003 form

Show details

Fax 281-500-4067 Short Form Mortgage Application Mini-1003 Page 1 of 2 DATE TIME LOAN OFFICER PURPOSE OF LOAN REFINANCE PURCHASE CONSTRUCTION EQUITY LINE PRIMARY BORROWER DOB //19 SSN -- PHONE H - PHONE W - PHONE C - CO-BORROWER DOB //19 CURRENT ADDRESS House No. Street City State Zip FOR PURCHASE LISTED HOME HOME TYPE SINGLE FAMILY DUPLEX MULTIPLEX TOWNHOME CONDO EST. MARKET VALUE HOME ADDRESS Y CASH OUT Y / N N AMOUNT REASON S FOR CASH YEAR PURCHASED YEAR BUILT ORIGINAL COST HOW LONG IN...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 1003 mortgage application form

Edit your form short mortgage application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage application template form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit short form mortgage application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form mini 1003. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mini 1003 form

How to fill out Mini-1003

01

Begin by gathering personal information such as your name, address, and contact details.

02

Provide your Social Security Number and date of birth for identification purposes.

03

Fill out your employment history, including employer names, addresses, and dates of employment.

04

List your income details, including salary and any additional sources of income.

05

Enter your assets, including bank accounts, real estate, and other investments.

06

Disclose any liabilities, such as credit card debt, loans, or mortgages.

07

Review all the information for accuracy before submitting the form.

08

Sign and date the form to certify that all information provided is true.

Who needs Mini-1003?

01

Individuals applying for a mortgage or housing loan to demonstrate their financial situation.

02

Real estate professionals assisting clients in securing financing.

03

Lenders and financial institutions requiring a standardized form for processing applications.

Video instructions and help with filling out and completing blank 1003 form

Instructions and Help about 1003 short form

Fill

mini 1003 application form

: Try Risk Free

People Also Ask about mortgage mini applicatioin

How many pages is the 1003 form?

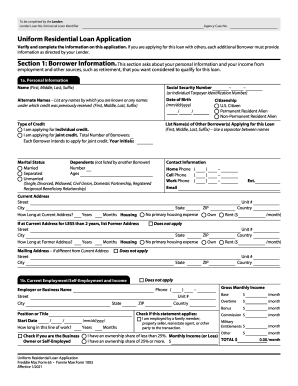

Known as the Uniform Residential Loan Application (or the 1003, after its Fannie Mae form number), this five-page document provides a lender with the basic information needed to approve a buyer.

Can you still use the old 1003?

All loans with an application date on or after March 1, 2021 and purchased by Fannie and Freddie are required to include the redesigned URLA. The GSEs will continue to accept legacy loans (applications prior to 3/1/21) with the old form 1003 until March 1, 2022.

What is the new 1003 form?

Key Takeaways. The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

When did the new 1003 become mandatory?

November 2, 2021-Following the March 1 mandate, which required the use of the redesigned Uniform Residential Loan Application (URLA/Form 1003) and Desktop Underwriter® (DU®) MISMO v3.

What is the alternative name for the 1003 loan application?

The application is known as Fannie Mae Form 1003 or Freddie Mac Form 65. Fannie Mae and Freddie Mac are government-sponsored companies that buy and sell home loans, freeing money for lenders to extend more loans to homebuyers.

Is the new Urla still a 1003?

All loans with an application date on or after March 1, 2021 and purchased by Fannie and Freddie are required to include the redesigned URLA. The GSEs will continue to accept legacy loans (applications prior to 3/1/21) with the old form 1003 until March 1, 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 1003 form directly from Gmail?

mini 1003 mortgage application and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete short form mortgage application mini 1003 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your form mini 1003 mortgage application by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I fill out form mini 1003 short mortgage application on an Android device?

Use the pdfFiller Android app to finish your short form 1003 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is Mini-1003?

Mini-1003 is a simplified form used in certain financial or regulatory contexts, typically to collect essential information for a financial transaction or application.

Who is required to file Mini-1003?

Individuals or entities applying for a specific financial product or service, often related to loans or mortgages, are required to file Mini-1003.

How to fill out Mini-1003?

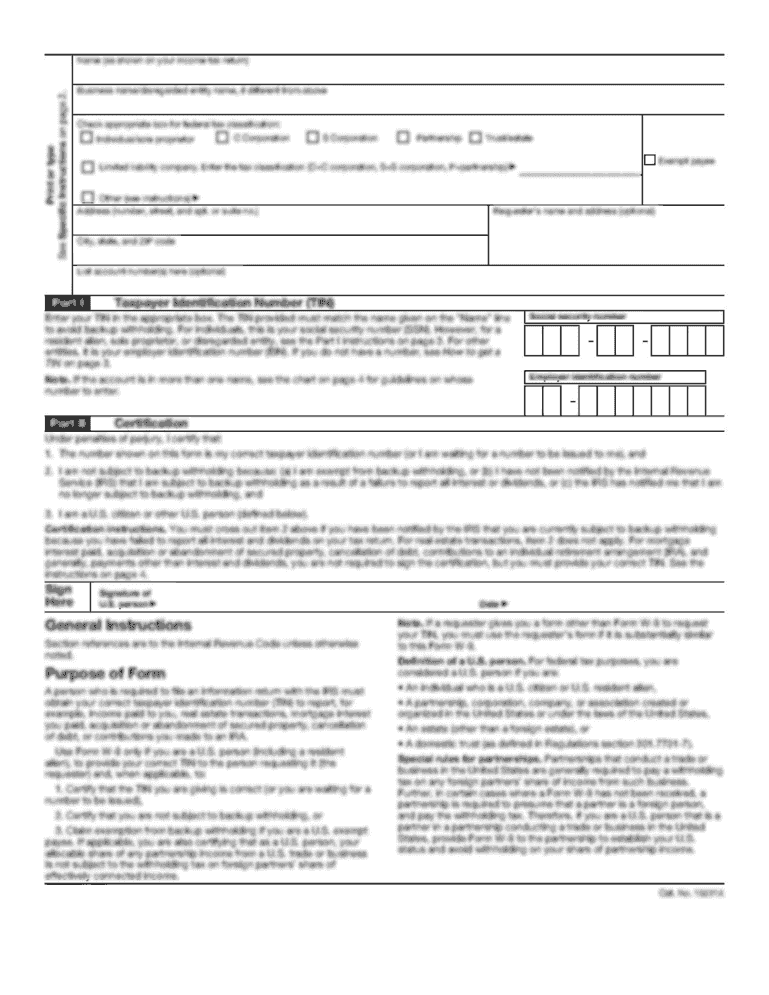

To fill out Mini-1003, follow the instructions provided on the form, carefully providing accurate information regarding personal details, financial information, and any necessary disclosures.

What is the purpose of Mini-1003?

The purpose of Mini-1003 is to gather necessary information efficiently from applicants to streamline the process for financial institutions in evaluating applications.

What information must be reported on Mini-1003?

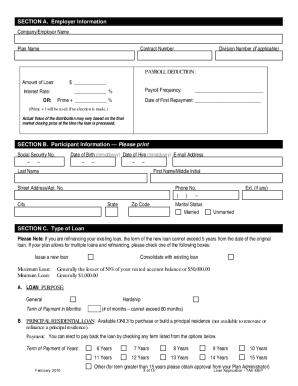

Mini-1003 typically requires reporting of personal information, income details, employment history, credit information, and any other relevant financial data required by the lender.

Fill out your Mini-1003 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mium 1003 Form is not the form you're looking for?Search for another form here.

Keywords relevant to mini1003 mortgage print

Related to mini1003 mortgage online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.